Whether you’re a team of one or have nationwide broker coverage, retailer POS data provides brands the ability to recognize and build upon their successful sales activities, address the biggest issues, and be more productive at generating sales. Unfortunately, many CPG brands under-utilize their retailer POS data when it comes to generating actionable insights the entire team can leverage to grow sales faster.

To ensure all emerging CPG brands have a fighting chance at success, Snowrise is highlighting critical sales insights that brand leadership and teams should be leveraging to prioritize their actions. If your brand has retailer POS data (ex. SPINS, Walmart, Wegmans, Whole Foods Market), yet the brand’s performance at the retailer is still a mystery, then you’re losing sales and wasting money.

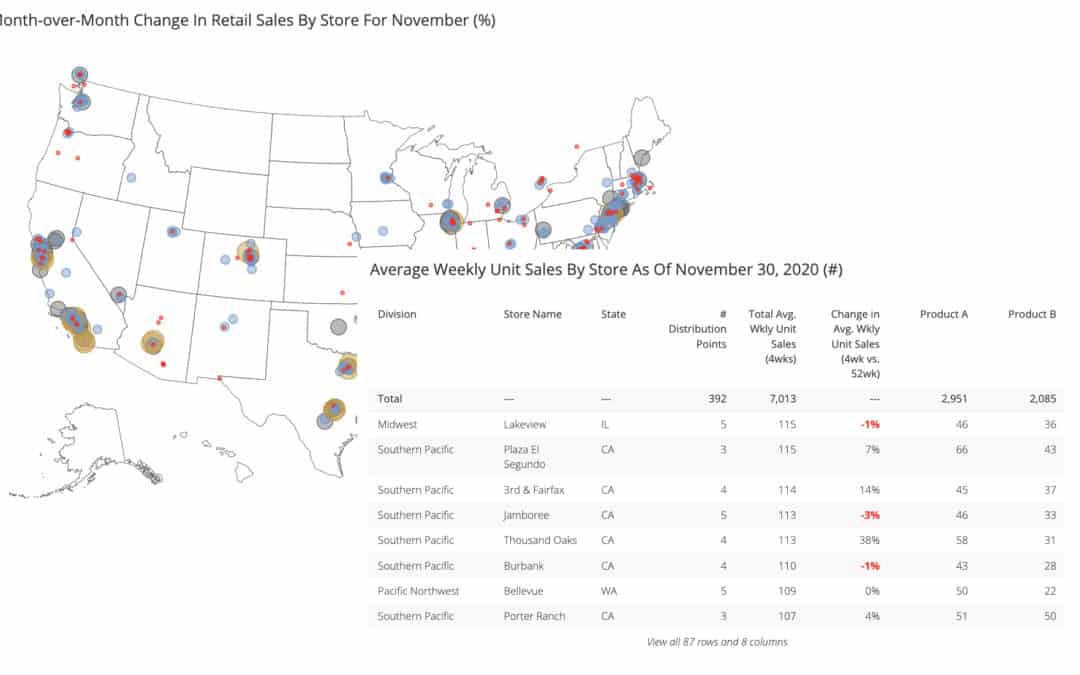

Store and Product Velocity Trends:

Scanning a spreadsheet to identify this month’s store-level sales is as far as most teams get, however, continuous communication of store-by-store and product-by-product velocity trends is both doable and incredibly valuable. Velocity changes highlight when and where issues exist so teams can act quickly before a product, or entire store, becomes a void.

Store Churn and Voids:

Every brand should know their store churn and voids so teams can target their efforts. Products are often accidentally dropped and can be re-introduced, and if the void reason is intentional, brands need to know the ‘why’ in order to optimize their sales, product, and pricing strategies.

For our customers, Snowrise analyzes velocities, days without a sale, and seasonality for each product at each store to identify out-of-stock and void situations. This approach flags voids at high-velocity stores more rapidly and allows high-velocity stores to be prioritized first.

Geographic Patterns:

Recognizing when store-level issues are concentrated by geography alerts teams to more concerning regional/distribution center issues that require immediate attention. Although some retailer POS data has geographical identifiers (ex. city, state, zip), the ability to identify store locations often requires brands to cross-reference the POS data with a store list containing the location details.

Snowrise maintains a store list with both address and latitude/longitude details for many retailers so that clusters are easily recognized when presented on a visual map.

Team Alignment and Performance:

Retailer POS data combined with account rep/broker/merchandiser store assignments facilitates the sharing of store-level insights with the right individuals who can act quickly, allows actual individual performance to be recognized, and eliminates the need for every team member to perform their own analysis.

If your brand has retailer POS data but the above sales insights elude you, please contact Snowrise (info@snowrise.net). There’s no reason why brand leadership and the sales team shouldn’t have and be able to act on these insights.

Recent Comments